Tax Management

Our Tax Management service makes sure your payroll taxes are paid correctly and on-time with the appropriate authorities allowing you to focus on your business and eliminating potential interest and penalty charges from the government. We are your solution to eliminate Tax Compliance worries.

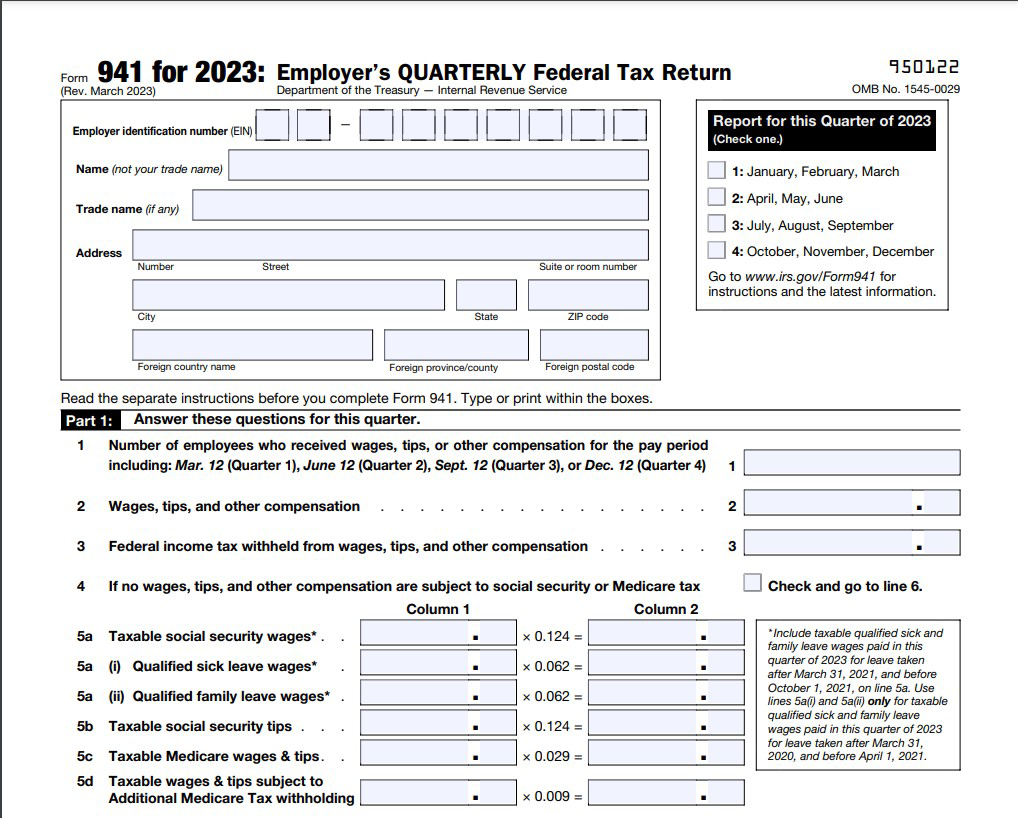

When using our Tax Management services, your business is automatically enrolled in the Electronic Federal Tax Payment System (EFTPS), which meets the Internal Revenue Service’s requirements for businesses to file and pay their 941 and 940 payroll taxes electronically.

All payroll tax returns and payments for Federal, State and Local agencies are completed on your behalf, keeping you compliant.

IRS 941 Form

IRS 940 Form

EFTPS(Electronic Tax Payment)

State Tax Payments and Filings

Year End processing includes W-2s and 1099s

Being a business operated by CPAs, dealing with your tax questions, notices or issues are handled very easily. We also work well with your entity’s CPA or Bookkeeper.